WISHING YOU HAPPINESS AS BIG AS GANESH’S APPETITE

LIFE IS LONG AS HIS TRUNK

TROUBLE AS SMALL AS HIS MOUSE

AND MOMENTS AS SWEET AS HIS LADDOS

SENDING YOU WISHES ON GANESH CHATURTHI!

Video - Indian Paper Mill Water Treatment

INDIAN PULP PAPER INDUSTRY - AN OVERVIEW

HISTORICAL RETROSPECTIVE

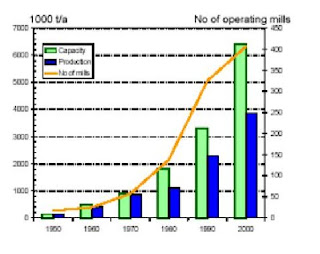

2011- 2012 will be a landmark year for Indian Paper Industry, as it will be completing two hundred years of its existence in India. As per the official records, the first paper mill was started in 1812 in Serampore (West Bengal). Though the initial years were not very encouraging due to lack of demand as well as political turmoil at national & global level, a few new mills were established between 1857- 1887. The real growth took place during the formative years of independent India. Started with imported pulp, bamboo became the main source of paper making fibers subsequently after development of technology of pulp making from bamboo. Since then, the paper industry has made a gradual progress coupled with certain hiccups / setbacks in between as an impact of global & national economic & political conditions. Today the industry occupies an unique position in Indian economy and is marked as a sector having mills of wide range of scale of operation, using diverse raw material for pulp & paper making and having mostly poor (with few exceptions) technological & environmental status. A road map of Indian paper industry over the years till date is indicated in Fig 1.1. As indicated in the road map a major growth in Indian paper industry occurred in 1970's, when to meet the paper demand and raw material shortage; excise concessions were given to small agro based mills, which resulted in a rapid increase of small mills as well as overall production capacity. In the late 1980s the industry was in a severe oversupply situation, capacity utilisation rates being around 60 %. However in early 1990s the government reversed this policy by removing excise concessions from agro based mills thus making large units more competitive.

PRESENT SCENARIO

Today the total number of pulp and paper mills in the country are estimated to be around six hundred (600) equivalent to an installed capacity of over 7.5 million tones which is likely to increase to 8.3 million tones by 2010 & over 14 million tones by the year 2020 . Fig 1.2 indicates growth in paper production and capacity of the country in last fifty years. Out of the total installed capacity about 1.26 million tonnes is idle (not in operation / closed).The present level of paper consumption in India is around 6.7 million tonnes which makes the per capita consumption of the country a meager 5.5 kg as against 332 kg in USA and world average of 54 kg. A comparative account of per capita paper consumption of some other countries is given in Table 1 . 1. With such lower per capita consumption the industry has a greater scope of further growth. The industry offers employment to more than 0.3 million people directly and about 1 million people indirectly

Indian Paper Industry �Classification

The Indian paper industry is generally classified broadly into following categories:

Classification Basis

Raw material Used Scale of Operation End products

• Wood based

• Agro based

•Recycled Fiber based • Large (Above 100 tpd)

• Medium (30-100 tpd)

• Small ( 5-30 tpd)* Writing & Printing, Newsprint, Rayon grade pulp

Writing & Printing, Newsprint, Packaging paper etc

Writing & Printing, Newsprint, Packaging paper etc

* Some RCF mills have production capacity up to 400 tpd

An estimated segregation of the total mills on the basis of raw material use is indicated in Table 1.2. As indicated in the table, each of the category is contributing nearly equal % to the total paper production. However less than 10% mills are using forest based woody raw material.

In present scenario, a distinct classification of mills under above categories becomes difficult as:

• Mills are mostly using mixed fibrous raw material furnish depending upon the availability. Some mills are using wood, agro residues (bagasse, sabai grass etc) & recycled fiber or imported pulp together to meet the raw material shortage & customer demands.

• A significant number of small & medium scale mills in recent years have expanded their pulp mill capacity to around 100 tpd and above so they are no longer medium/small scale. However most of them do not have chemical recovery system.

• Some agro based mills have installed chemical recovery system.

• The mills are producing multiple end products as per the market demand.

CPCB has classified the pulp & paper mills on the basis of chemical recovery system i.e.:

• Mills with chemical recovery system ( i.e large integrated mills)

• Mills without chemical recovery system.( small &medium scale mills)

INVENTORISATION , DISTRIBUTION & CATEGORISATION - LARGE SCALE INTEGRATED PULP & PAPER MILLS

1.1.1 Inventorisation

There are twenty eight (28) large scale pulp and paper mills in the country of which 20 are currently in operation. The inventory list of large scale pulp & paper mills is indicated in Table 1.3. As indicated in the table, the most of the mills included in the list use mainly mixed hardwood & bamboo except few which use bagasse / RCF also along with hardwood. The paper production capacity of these mills varies from 150 - 700 tpd according to data available.

On the basis of quality of paper/ pulp produced the large paper mills may be categorized into:

- Writing & Printing Mills

- Newsprint Mills

- Rayon Grade Mills

However; due to recession in newsprint market as well stiff competition in domestic markets with foreign suppliers, some newsprint mills have started manufacturing writing & printing paper also. The large mills are distributed all over the country .The major factors governing their location are primarily availability of resources such as water , raw material , coal etc. The state wise distribution of the major large pulp & paper mills is summarized in Table 1. 4 and indicated in Fig 1.3. As indicated in the above mentioned table & figure Andhra Pradesh accounts for maximum number of mills (4) followed by Karnataka (3). Except rayon grade pulp mills almost all the mills produce mixed range of end products including some producing both writing and printing & newsprint paper.

Based on application the major end products can be broadly classified into following segments:

Paper Segment Application Example

Cultural Papers Stationary & publication Maplitho, cream wove, copier, speciality paper, coated paper etc

Industrial Paper Packaging Kraft, pulp board, duplex board etc.

Newsprint News paper, magazines, periodicals etc. Newsprint

Fibrous Raw material Usage

There is a great variation in the type of raw materials used by these mills. The use of fibrous raw material primarily depends upon the regional location of the mill and ease of availability. The common fibrous raw materials used are bamboo, eucalyptus, mixed hardwood, waste paper, imported pulp, bagasse, straws, sarkanda, grasses etc.

TECHNOLOGICAL STATUS OF LARGE SCALE INTEGRATED PULP & PAPER MILLS

Around 35- 38% of the total paper production is provided by large scale sector. The large paper mills still continue with conventional obsolete technologies and equipments including paper machines with few exceptions which have adopted stat of art technologies for manufacturing of paper & also for improved environmental management .

A brief account of the various process operations followed in large paper mills is discussed as under:

Raw Material Handling

The major fiber sources for pulp & paper making include bamboo and mixed hardwoods from forest fellings, Eucalyptus, Casurina , Poplar , Bagasse, RCF etc.The woody raw material is stored in yards (usually open). Debarked woody raw materials are chipped in chipper house followed by washing to remove dust, dirt etc. Debarking is usually carried out manually. Bagasse is usually stored in heaps in baled form and is kept wet to avoid further deterioration during storage and auto combustion as bagasse is a seasonal raw material & has to be stored in bulk. Mills using bagasse normally practice wet depithing for pith / dust removal. The recycled fiber used by the mills is both indigenous & imported depending upon the availability and requirement of the end product.

Pulping

Almost all mills employ sulfate/kraft process (using NaOH & Na 2 S with sulfidity level 18-25%) for producing writing and printing paper. Most of the large mills generally employ Vertical Stationary Digesters (VSD) with capacities 60-120 m 3 having indirect heating arrangements using pre heaters. Depending upon the capacity, mills employ blow heat recovery system by which waste heat recovery is accomplished alongwith defiberation of the cooked material. Very few mills have continuous digesters. Only one mill employs modified pulping process to reduce kappa number of pulp to about 18-20. Rayon grade mills employ prehydrolysis process before sulfate process to produce unbleached pulp of kappa number around 10-12 while newsprint mills use both sulfate & mechanical pulping process (CMP & TMP). Newsprint mills use major proportions of mechanical pulp in the fiber furnish. The pulp yield for chemical pulp, semi-chemical and mechanical pulp is generally in the range of 40-45%, 60-70% and 80-85% respectively. The kappa number of unbleached pulp produced in most of the mills ranges between 14 -24 for producing writing and printing paper and major part of lignin is still removed in subsequent bleaching stage. Recycled fiber is usually processed in hydra pulper followed by deinking.

Pulp Washing

Most of the pulp mills normally use brown stock washers for washing of pulp using counter current washing practices. The washing efficiency of these washers in most of the mills is not very satisfactory as evidenced by high carry over of black liquor COD along with pulp going to bleaching section ( 25-30 kg/t pulp ) resulting in high chlorine consumption in bleaching stage. With increasing awareness about the need of improved pulp washing on over all environment and economics, some of the mills in India have employed state of art pulp washing system . For example APPM has recently employed a new single Chemi-washer system which is a horizontal belt type washer of five stage counter current washing and is completely closed with hood . The main advantages of this system are:

• Low dilution factor.

• High spent liquor concentration ( around 19%).

• High washing efficiency.

• Excellent turndown ratio at sustained high efficiency.

• Small space requirement.

• No intermediate filtrate tanks.

Similarly two mills namely ITC and West Coast have adopted Twin roll press for efficient washing. The presses work on the principle of dewatering �displacement -pressing .The major merits of such system are reduced water consumption& space requirement , reduced COD carryover, increased solids in weak black liquor leading to improved chemical recovery, reduced bleach chemical consumption, reduction in pollution load including AOX. Similarly, Bilt �APR has installed a displacement drum system which involves five stages washing within a single drum thus having advantages of reduced space requirement as well as the other advantages as above.

Oxygen Delignification

Oxygen delignification process is a well established technology used to treat unbleached pulp to reduce kappa number before bleaching of pulp in order to reduce chlorine demand. J.K. Paper Mill has been the pioneer in introducing oxygen delignification process in the country. ITC Bhadrachalam is the other mill to introduce new fiber line including oxygen delignification .Around 40-50% kappa number of unbleached pulp is reduced by the use of oxygen delignification process. The filtrate from the process containing organic matter is sent to chemical recovery system.

Bleaching Practices

The large mills normally use elemental chlorine and hypochlorite for bleaching of pulp to desired level of brightness. Some of the mills are using chlorine dioxide alongwith elemental chlorine in chlorination and subsequent bleaching stage to attain high brightness of pulp. However, elemental chlorine is still the dominating bleaching chemical in use due to economic reasons. With increasing pressure to meet the AOX discharge norms over the years there has been a gradual trend to use chlorine dioxide to improve the quality of pulp & bleach plant effluent quality .Further , around ten mills have till date have incorporated chlorine dioxide in their bleaching sequence. Newsprint mills generally use hydrogen peroxide for bleaching of mechanical pulp and conventional bleaching techniques for chemical pulp. Rayon grade pulp is generally bleached using elemental chlorine, sodium hypochlorite followed by chlorine dioxide to produce pulp of higher brightness.

Stock Preparation & Paper Making

Stock preparation is an important & integral part of paper manufacturing which influence the quality of finished paper. Around 10-15% of various chemicals are used in combination for development of physical & optical properties of paper. The average capacity of paper machines is about 14 000 t/ annum. Most of Indian paper machines have a trim width from 1.5 to 3.5 m. There are only nine paper machines with trim width of five meter or more. Only fourteen machines have capacities 50, 000 t/ annum or more. Thus even the largest machines in India appear to be medium size when compared internationally as the paper machines in mills abroad operate in the in the range of 400 000- 600 000 t/ annum, and have a trim width up to ten meters.

Most of the mills have fourdriner paper machines except newsprint which use twin wire machine. Most of the mills, established long back have multiple machines of low capacity. New mills have usually less number of machines with higher production capacity. The paper making process uses huge amount of water. However the general trend is to reuse /recycle the paper machine filtrate after clarification within the internal process.

Chemical Recovery Process

All the mills are equipped with the conventional chemical recovery system to recover chemicals and energy. With increasing emphasis on reducing cost of production a number of mills are going for retrofitting / upgradation of their existing recovery plants or installation of new recovery systems to improve the efficiency. The recovery efficiency of existing systems in general is around 88 -94% as compared to 95-98% in developed countries.

Lime kiln

Lime sludge generated during the causticisation of green liquor constitutes the major proportion of solid waste generated in large pulp & paper mills. Till recent past barring a handful of mills, most of the mills were disposing off the lime sludge on near by land. However during the last decade, an increasing number of mills have installed the rotary limekiln to reclaim lime in view of environmental considerations as well as for resource conservation. At present around 40% of the total mills in the country are having lime kiln. The status of lime kiln in the mills is indicated in Table 1.5

Utilities

Most of the large mills are integrated mills having captive power generation. Most of them are self sustained in terms of meeting power requirement. Only a fraction of the total power requirement is purchased from grid by some mills.

A comparative picture of technological status of Indian mills v/s mills abroad is indicated in Table 1.6.

ENVIRONMENTAL MANAGEMENT IN PULP & PAPER MILLS

With increased environmental awareness, public pressures & strictness of regulatory authorities, the environmental management has been the major concern of pulp and paper industry and in last decade the industry has made remarkable efforts in the area of resource conservation and environmental management .As a result the volume of waste water discharge and magnitude of pollution load has drastically reduced from the level prevailing before 1990's.Today in spite of having all inherent limitations , improved product quality coupled with resource conservation and cleaner environment are on the top priority in the agenda of the every pulp and paper mill to make itself and the industry on the whole, competitive and environmentally sustainable .A brief description about the practices followed for handling and management of wastes are given below:

Liquid Wastes

Pulp and paper industry requires huge amount of water and major part of which (i.e. around 90%) is discharged as waste water . The waste water discharge varies from mill to mill; depending upon the raw material used and process employed . The waste water discharge varies between 150-175 m 3 /t paper in newsprint and rayon grade pulp mills while in writing and printing paper mills, the waste water discharge varies generally from 100-175 m 3 /t paper . The major sources of liquid waste are summarized in Table 1.7. The large paper mills have exhaustive effluent treatment facilities mostly based on Activated Sludge Process (ASP). The process includes primary clarifier for removal of suspended particles followed by biological treatment through activated sludge process. The excess bio sludge is removed through secondary clarifier. Rayon grade mills use anaerobic system for treatment of concentrated prehydrolysis liquor which contains mainly degraded sugars, fatty acids etc. and biogas recovered is used as fuel. The lay out of conventional activated sludge process is given in Fig 1.4. In recent times there has been increasing practice of use of final treated effluent by the mill or the local farmers for horticulture, gardening, irrigation of crops and plantations.

Solid Wastes

The major proportion of solid wastes generated in large mills is inorganic in nature such as lime sludge, cinder and flyash .The estimated quantity of lime sludge, cinder and fly ash generated per annum in paper industry is around 0.8,0.6, 0.105 million tonnes respectively. The general practice is to dispose off the lime sludge as such on land. Some mills have lime kiln to reburn lime sludge to recover lime for reuse in recausticisation. Now with increasing environmental pressures and non availability of land fill sites, an increasing number of mills are going for installation of lime kiln. A few mills are exploring the possibilities as well as some are already manufacturing value added products like bricks from lime sludge and fly ash. ETP sludge is mostly sold to the near by board mills for producing cheaper grade of boards or disposed off in low lying areas.

Air Pollutants

The major sources of air emissions are through discharge of gaseous and particulate emissions. The air pollutants can be classified into two major categories:

• Primary Pollutants

• Secondary Pollutants

A brief summary of major air pollutants are as under:

Major Class Sub class Constituents

- Inorganic gases Oxides of Nitrogen Nitric Oxide, Nitrogen dioxide

- Oxides of Sulfur Sulfur dioxide, Sulfur trioxide

- Oxides of Carbon Carbon mono oxide, Carbon dioxide

- Organic gases Hydrocarbons C1 �C5

- Aldehydes or Ketones Formaldehyde, Acetone

- Mercaptans H 2 S ,CH 3 SH, (CH 3 ) 2 SH etc

- Particulates Solids Fume, dust, smoke, ash, carbon ,lead

- Liquid Mist spray, oil, grease, acids

PRESENT NATIONAL ENVIRONMENTAL LEGISLATIONS / DISCHARGE STANDARDS

The discharge standards for large pulp & paper mill at present have been enforced by Central pollution Control Board (CPCB) under environment protection rules 1986. In India Central Pollution Control Board (CPCB) is the main regulatory authority in terms of enforcement /implementation of environmental rules and regulations in the country. In addition there are State Pollution Control Boards which also assist CPCB in the implementation of the pollution norms as well as have their own discharge norms / environmental rules for respective state. The discharge standards for liquid effluents have been categorized into two categories namely- for mills set up before & after 1992 and are indicated in Table 1.8 .

For air emissions CPCB has laid down general ambient air quality standards as mentioned in Table 1.9. CPCB has prescribed specific standards of particulate matter and hydrogen sulfide in air emissions for large pulp & paper mills ( Table 1. 10) as well as limekilns emissions ( Table 1. 11). However there are no standards for fugitive or non-condensable gases emissions.

For solid waste disposal also there are no rules though there are rules for management and handling of biomedical waste, municipal waste etc However the CREP charter (discussed in para 1.5.7 ) has made it mandatory for large mills to install lime kiln within four years.

ISSUES BEFORE LARGE SCALE PULP & PAPER MILLS

Technological Issues

The major technological issues concerning the sustainability of large scale pulp & paper mills are :

Raw Material Availability

Current forest plantations in India are estimated at 32. 5 million hectare, of which 90 % is based on hardwood, mainly eucalyptus and acacia ( Fig 1.6 ) As indicated in the Fig 1.7 , the paper industry's wood demand is expected to grow from 5.8 million tons to 9 million tons by 2010, and to over 13 million tons by 2020 (assuming that part of fibre needs are covered by increasing use of waste paper and agro residues). There is an urgent need to evaluate the state of current plantations and their potential / accessibility for pulp and paper industry in near future. About 0.6 million hectare land for plantations would be required to meet the paper industry's wood demand. India has about 100 million hectare of waste land and 32 million hectare of degraded forest land. A small part of this if made available to paper industry for plantations can be helpful in meeting the raw material requirements of the industry.

Though the recovery of wastepaper ( RCF) has increased from 6,50, 00 tonnes in 1995 to 850000 tonnes in 2000, still the recovery rate for paper industry is only 20% which is very low compared to countries such as Thailand (42%), China (33% ), Germany (71% ). The Indian recovery of RCF is not keeping pace with recycled paper utilization, resulting in an increase in imports. The reasons for this are mainly - the alternative use of waste paper & unorgansied / unsophisticated recovery & trading of RCF. Multiple use of paper products (as wrapping papers, packaging applications, etc.) is common in India, and often these end uses pay better price for waste paper than paper industry.

High Cost of Basic Inputs

The level of major basic inputs ( water, steam, power , chlorine, manpower etc) required for producing paper is quite high compared to international bench marks leading to high cost of production due to which the Indian mills are at disadvantage both in domestic market as well as international market. Moreover the cost of raw material & purchased power are quite high as compared to international standards as indicated in Fig 1.8 & 1.9 respectively

Uneconomic Scale of Operation

The average scale of operation of large scale integrated pulp & paper mills varies generally from 150 to 350 tpd (except few mills of 600-700 tpd) which is far lower compared to international standards of 1000- 2000 tpd. The low scale of operation of Indian mills coupled with low capacity utilization due to old machines and equipments and high cost of basic inputs results in increased cost of paper production making it difficult to compete with price of imported paper products.

Ecofriendly State of Art Processing Technologies

In developed countries paper making has become a state of art technology and the mills are using ecofriendly process and technologies. The low scale of operation of Indian mills makes their adoption a liability for a mill in general as most of these technologies are capital intensive and of imported origin .As a result only a few mills till date have been able to adopt/ employ new fiber line involving modified pulping process ,oxygen delignification, ECF bleaching , new washing systems etc.

Environmental Issues

The major environmental issues before the Indian paper industry which are affecting the over all sustainability as well as its competitiveness are summarised as under :

• High volume of effluent.

• Discharge of chlorinated organic compounds such as AOX, dioxins & furans.

• High color in effluents.

• Solid waste management / disposal (ETP sludge, lime sludge, fly ash etc).

• Odor problem due to non-condensable gases containing mercaptans.(NCG's).

High Volume of Effluent

The reduction in water consumption is one of the major issues as the Indian paper mills consumes high quantity of water primarily due to use of mixed fibrous raw material ,old obsolete equipments and multiple paper machines which results in discharge of high volume of the effluent . However the mills in the last decade have made all possible efforts to reduce the discharge of waste water and the mills have been able to reduce effluent discharge from around 300 m 3 / t paper to 150 m 3 / t paper ( on an average).

With growing awareness about water as a precious commodity, water conservation is on top agenda of every paper mill. CPCB has further lowered the targets for effluent discharged making it mandatory for the mills to evaluate the options for increased recycling of water within the process as well as explore areas for in house reduction of water consumption. However recycling of water has limitations due to build up of inorganic salts, which may affect the product quality & process operations.

Discharge of Chlorinated Phenolic Compounds

Most of the large mills continue to use conventional bleaching techniques.In recent times only a few mills have started use of chlorine dioxide for bleaching of pulp .The elemental chlorine is the major contributor for discharge of AOX and the level of AOX in large mills vary in general from 3-4 kg/ t paper .The discharge of AOX is lower in mills employing relatively modern technologies. CPCB has included AOX as a major regulatory parameter in the CREP Charter to be addressed by the mills in fixed time frame. The reduction in AOX level can be achieved through adoption of oxygen delignification , ECF / TCF bleaching techniques .

Low Efficiency of Pulp Washers .

Due to inherent nature of our fibrous raw materials specially agro residues as well as use of mixed raw materials, the performance efficiency of the existing pulp washing system is usually below the optimum level leading to high COD carry over and high soda loss. The higher COD carryover in turn leads to high chlorine consumption to achieve the desired brightness level and ultimately high level of AOX.

Low Performance Efficiency of Effluent Treatment Systems

Generally it is observed that mills are not using optimal capacity of their effluent treatment facilities primarily due to lack of monitoring. In general, the conventional activated sludge treatment process is a liability in terms of inputs like chemicals, power etc. Further in some cases mills have over the years undertook expansion of their pulp mill capacity without corresponding expansion of the effluent treatment plants capacity. As a result most of the effluent treatment plants are overloaded.

High Colour of the Effluents

Issue of high colour in the effluent is basically a public perception problem rather than an environmental problem. Still to address to the public as well as legislative concerns the colour reduction is one of the top priority areas before the mills. Though the techniques are available but the techno-economic factor is the major constraint in their adoption.

Solid Waste Management

Management of solid waste like lime sludge, flyash , cinder , ETP sludge etc will be a big environmental challenge for Indian mills in the coming days . Many large scale mills are still not having lime kiln and hence dispose off the lime sludge along with other wastes on land leading to detrimental effect on land / soil properties as well as effecting the quality of ground water .

Control of Air Pollution

Mercaptans released during digester relief / blow & black liquor evaporation are a major concern for the mills, which are located in or near the city. Though the technologies for collection and incineration of the obnoxious gases are available but R&D efforts are required to develop simple and economical methods for collection of mercaptans and their incineration in the existing recovery boilers or limekilns.

TABLE -1.1

Comparative Per Capita Paper Consumption in Different Countries

Country Per capita consumption, kg

USA 332

Sweden 247

Japan 242

UK 206

Korea 159

China 29

Thailand 32

India 05

World Average 54

Asian Average 27

TABLE � 1.2

Segregation of Indian Mills ( Basis: Raw material Use)

Raw material Number of Mills Scale of Operation % Contribution to installed capacity

A. Wood 32 100-700 38

B. Agro Residues 110 30 �100 32

C. Recycled Fiber 383 5- 400 30

TABLE �1.3

INVENTORY OF LARGE SCALE PULP & PAPER MILLS

S.No Name of the Mill & Location Raw Material End Products

1. Andhra Pradesh Paper Mill ,Rajamundry A.P. Hardwood,Bamboo Writing & Printing

2. Bilt (Unit Shree Gopal) , Yamunanagar ,Haryana Hardwood,Bamboo Writing & Printing, Speciality Paper,

Industrial Paper

3. Bilt (Unit Ballarpur ),Ballarshah, Maharashtra Hardwood,Bamboo Writing & Printing & Industrial Paper

4. Bilt (Sewa),Gaganpur ,Orissa Hardwood & Bamboo Writing & Printing

5. Bilt �APR,Kamlapuram,A.P. Hardwood Rayon Grade & Paper Grade Wood Pulp

6. Central Pulp Mills Ltd, Songadh,Gujarat Hardwood,Bamboo Writing & Printing

7. Century Pulp & Paper , Lalkuan , Uttranchal Hardwood, Bagasse,

Bamboo Dissolving grade/paper grade pulp ,

Writing & Printing

8. Harihar Poly fibers, Karnataka Hardwood Rayon grade pulp

9. Hindustan News Print Ltd, Kerala Reed ,Bamboo,

Hardwood Newsprint

10. HPC �Nagaon Paper Mills Ltd,Kagajnagar, Assam Bamboo Writing & Printing

11. HPC �Cachar Paper Mills Ltd, Cachar , Assam Bamboo Writing & Printing

12. ITC Ltd- Paper Board & Speciality Papers Division,Sarpaka A.P Hardwood & RCF Writing & Printing & Speciality Paper and Board

13. J.K.Papers,Rayagada,Orissa Hardwood, Bamboo Writing & Printing

14. The Mysore Paper Mills Ltd ,Bhadravati Hardwood,Bamboo,Bagasse Newsprint and Writing & Printing

15. Orient Paper Mills ,Amlai, M.P. Hardwood, Bamboo Writing & Printing & Speciality Paper and Board

16. The Sirpur Paper Mills Ltd ,Sirpur ,A.P. Hardwood,Bamboo,Purchased pulp & RCF Writing & Printing ,Kraft

17. Star Paper Mills Ltd,Saharanpur,UP Hardwood, Bamboo Writing & Printing, packaging & industrial grades

18 Seshasayee Paper &Boards Ltd, Erode,Tamilnadu Bagasse,Hardwood &RCF Writing & Printing

19. Tamilnadu Newsprint & Papers Ltd ,Karur,Tamilnadu Bagasse & Hardwood Newsprint and Writing & Printing

20. West Coast Paper Mills Ltd, Dandeli,Karnataka Hardwood Writing & Printing

Note :

The following eight mills are not in operation / closed :

Ashok Paper Mills Ltd,Assam, Bengal Papers West Bengal, Orient Paper Mills, BrijrajNagar,Orissa, Teetagarh Paper Mills Ltd ,West Bengal , Sri Rayalseema Kurnool ,Nagaland Paper Corporation ,Nagaland Nepa Ltd ,NepaNagar,M.P.& SIV Industries Ltd.,Coimbatore,Tamilnadu

The above inventory does not include mills using purely agro residues or RCF and having capacity above 100 tpd

TABLE - 1.4

State Wise Distribution of Large Integrated Pulp & Paper mills

Name of State No. of Mills Name of the Mills

Andhra Pradesh Four APPM , Bilt �APR , ITC, Sirpur

Assam Two HPC �Nagaon, HPC �Cachar

Gujarat One CPM

Haryana One Bilt �Yamunanagar

Karnataka Three Mysore , Harihar Polyfiber,West Coast

Kerala One HNL

Madhya Pradesh One Orient

Maharashtra One Bilt �Ballarshah

Orissa Two JK , Bilt �Sewa,

Tamilnadu Two TNPL , Seshasayee

Uttar Pradesh One Star

Uttaranchal One Century

TABLE-1.5

Status of Lime Kiln in Large Pulp & Paper Mills

S.No Name of the Mill & -Location -Status

1. Andhra Pradesh Paper Mill , Rajamundry A.P. -Yes

2. Bilt (Unit Shree Gopal) , Yamunanagar ,Haryana- Yes

3. Bilt (Unit Ballarpur ), Ballarshah, Maharashtra- No

4. Bilt (Sewa), Gaganpur ,Orissa No

5. Bilt �APR, Kamlapuram,A.P. -Yes

6. Central Pulp Mills Ltd, Songadh,Gujarat -No

7. Century Pulp & Paper , Lalkuan , Uttaranchal -Yes

8. Harihar Poly fibers, Karnataka -Yes

9. Hindustan News Print Ltd, Kerala -Yes

10. HPC �Nagaon Paper Mills Ltd, Kagajnagar,Assam -No

11. HPC �Cachar Paper Mills Ltd, Cachar, Assam -No

12. ITC Ltd- Paper Board & Sarpaka A.P-Yes

13. J.K.Papers,Rayagada, Orissa-No

14. The Mysore Paper Mills Ltd , Bhadravati-No

15. Orient Paper Mills , Amlai, M.P.-No

16. The Sirpur Paper Mills Ltd , Sirpur ,A.P. -No

17. Star Paper Mills Ltd, Saharanpur,UP-Yes

18 Seshasayee Paper &Boards Ltd,Erode,Tamilnadu -No

19. Tamilnadu Newsprint & Papers Ltd ,Karur,Tamilnadu -Yes

20. West Coast Paper Mills Ltd, Dandeli,Karnataka -Yes

TABLE �1.6

Comparative Benchmarks of Pulp & Paper Mills � National & International

Parameters Mills Abroad (Mainly W.Europe) -Best Mills in India

Water Consumption - m 3 / t paper 5-40 -40-150

Steam Consumption - GJ / t paper 4 - 8 -15 - 30

Power Consumption - kWh / t paper 400-800 - 800-1500

Chemical recovery - % 95-99 - 88-94

Productivity - tpa/person 800-3500 - 25-300

TABLE-1.7

TABLE �1.8

Existing Waste Water Discharge Standards for Large Pulp & Paper Mills

Parameters Standards

Volume, m 3 /t paper Writing & Printing :200 (100)*

Rayon grade/ News print: 150

pH - 7.0 - 8.5

BOD 5 at 20 0 C - mg/l 30

COD - mg/l 350

SS - mg/l 50

TOCl - kg/t paper 2.0

Figures in bracket are for new mills set up after 1992

TABLE-1.9

TABLE �1.10

Existing Emissions Standards for Large Pulp and Paper Mill

Parameters Standards

Particulate matter 150 mg/Nm 3 H 2 S 10 mg/Nm 3

TABLE �1.11

Emissions Standards for Limekilns

Capacity of Kiln Parameter Standard Upto 5 t/day Particulate matter

A hood should be provided with a stack of 30 m height from ground level (including Kiln height)

5-40 t/day Particulate matter 500 mg/Nm 3

Over 40 t/day Particulate matter 150 mg/Nm 3

Fig -1.1 Road Map of Indian Paper Industry

Fig �1.2 Growth of Indian Paper Industry (1950-2000)

Fig �1.3 Distribution of Major Large Pulp & Paper Mills in the Country

Fig -1.4 General Layout of Effluent Treatment by Activated Sludge Process

Fig �1.5 Major NCG Emissions in Different Process Operations

Fig- 1.6 Distribution of Forest Plantation in India

Fig �1.7 Projected Wood Demand in Indian Pulp & Paper Industry

Fig �1.8 Comparative International Hardwood Prices

Fig �1.9 Comparative International Purchased Power Prices

I

VIDEO-PAPER COST

PAPER COST INCREASE Direct marketers and catalogers are preparing to face paper cost increases this fall, while also planning for a possible significant postal rate increase in January.

Marketers say volatility in the paper market in recent years, due to economic instability, has made it difficult for them to project costs from one year to the next. Many marketers are facing paper price increases of as much as $3 per 100 pounds this fall, on top of prior hikes in April and July, according to notices from paper mills and industry experts.

The increase means a 7% to 10% cost increase for buyers, depending on the mill and type of paper.

“Every increase changes our plans, and we no longer do long-term paper company contracts,” said Ashton Harrison, owner of Shades of Light, a home decorating goods cataloger. “I no longer run my business the way I did five years ago. If you told me before that I’d run a business like this, it would scare me.”

Harrison said her company produces seven drops a year totaling just fewer than 2 million catalogs, half as many as six years ago.

“It’s still an effective channel [to mail] but it costs too high a percentage of our sales,” she said. “It costs us more to mail our marketing pieces than it does to ship our goods to our customers.”

Harrison said that 10% of her company’s sales revenue goes toward postage expenses, up from about 8% six years ago.

“This is not good news for catalogers,” said Hamilton Davison, president and executive director at theAmerican Catalog Mailers Association. “They’re going to get a postage increase that’s six-times the rate of inflation and a paper cost increase that is nine times the inflation rate [for the year].”

Paper mills are raising prices due to both less supply and greater demand for paper among customers, a category that includes both marketers and printers, according to industry experts.

“Much of the increase is just getting paper prices back to a more normal level. With this third increase now announced, we’ll have seen a significant increase in paper costs since January,” John Maine, VP of world graphic papers at RISI, an information and analysis resource organization for the paper industry, who noted that prices dropped last year. “Paper prices for 2010 will still be below 2009′s average by 3%.”

The increased demand is a result of not only more catalog printing, but widespread closures and machine shutdowns among paper manufacturers. Numerous midsize North American companies have either decreased capacity or gone out of business in the past year, accounting for less than 700,000 tons of coated paper output capacity for the year.

Paper price increases could prove costly for mills in the long run, according to Dan Walsh, VP of publication and catalog papers at Bradner Smith & Company, a paper merchant company.

“I really empathize with the mills who have had such a hard time in our dour economy, but I also see my clients, catalogers and publishers, who are doing whatever they can do to survive. These increases, while necessary for the mills, are forcing direct marketers to make changes which, in turn, will hurt the mills,” Walsh said.

Harrison said that prospecting once accounted for 75% of all catalog mailings, but her company has now replaced a significant portion of that with online ads and search engine optimization.

However, it is unlikely that marketers will move away from catalogs and direct mail en masse.

“Generally speaking, today’s marketer is most successful with a data-driven multichannel marketing strategy,” said Paul Imbierowicz, SVP of strategy and planning at Epsilon Targeting. “For many of our catalogers, they are so heavily focused on direct mail and their consumers have a strong preference for this channel, it will be hard to make the shift to digital.”

Video-SUZANO Pulp and Paper Mill- Round Up

REVIEWING THE DEVELOPMENT PROCESS OF THE PAPER TO DISCOVER THE OPPORTUNITIES AND CHALLENGES

105 AD, Cai Lun was inspired by the wash rice, using bark, rags, hemp fiber, etc. mixed together, and fashioned plant fiber paper, which is the prototype of the modern paper. According to statistics, every 1 ton of recycled paper can be recycled 800 kg out of a good paper, save 17 trees, saves 3 cubic meters of landfill space, you can save energy more than 50% of the paper, to reduce water pollution 35% .

Paper is one of the four great inventions in ancient China, is an indispensable item in our lives.

105 AD, Cai Lun was inspired by the wash rice, using bark, rags, hemp fiber, etc. mixed together, and fashioned plant fiber paper, which is the prototype of the modern paper. After the paper-making technology spread all over the world, greatly accelerated the progress of human civilization.

In recent years, China's paper industry technical capability and constantly raise the level of modernization and achieving sustainable development of green manufacturing and a virtuous circle. Paper industry relies on technological advances and information transformation, onto a high technology content, good economic returns, low resource consumption, little environmental pollution and human resources into full play, full use of both domestic and overseas resources, a new road to industrialization.

Today, digital means to significantly reduce the consumption of traditional paper, electronic paper is read to open a new era. Relying on electronic ink technology, electronic paper, both traditional paper reading sensory properties, also has a mass storage function.

(A) of the green earth, health, life, home environment, clean and hygienic living environment, can not do without the security and protection of forests. But a lot of paper used in the consumption of forest resources in fact.

Forests can provide us with oxygen, absorb carbon dioxide, sand-fixing, water conservation, the maintenance of ecological balance. In accordance with international environmental functions of trees common statistical terms, each tree occurring ecological benefits, environmental benefits, social benefits and other integrated value up to 200,000 yuan.

Pulp demand growth led to rapid growth in wood consumption. China's annual paper consumption of around 10 million cubic meters of wood, wood pulp imports more than 130 million tons, more than 400 million tons of imported paper. Paper consumption not only causes a lot of forest area dropped sharply due to production of pulp and discharges to rivers and lakes are seriously polluted. Now, the earth an average 4000 square km of forests disappearing.

Protect forests, reduce the amount of logging to be recovered from the paper to start.

According to statistics, every 1 ton of recycled paper can be recycled 800 kg out of a good paper, save 17 trees, saves 3 cubic meters of landfill space, you can save energy more than 50% of the paper, to reduce water pollution 35% . Each paper can be recycled at least twice. Office paper, old envelopes, stationery, notebooks, books, newspapers, advertising paper and the first recovered, can be printed on recycled paper into books, writing paper, etc.; secondary recovery, you can use recycled paper production and daily life.

Many developed countries have paid great attention to production of high-grade household paper using waste paper and office paper. United States, the world's largest manufacturer of toilet paper is 100% use of recycled paper production and life, Nissan recycled 1,400 tons of pulp, paper annual output of 1 million TEUs of life.

China is big country paper is paper consumer. In recent years, rapid development of China's paper industry, annual production of 93.89 million tons, consumption of more than 9,000 tons, ranking first in the world. At present, waste paper recovery rate of only 30%, lower than 47.7% of the world average, waste paper recycling potential.

To this end, China has been working to accelerate the pace of recycling waste paper, the development of circular economy and building a conservation-oriented society.

The difficulty lies in paper recycling used paper deinking pulp. Developed countries have mastered advanced technologies mature deinking, China after several years of technology acquisition and digestion also made great progress.

(B) a long time, traditional Chinese paper industry is considered high pollution, high energy-hungry. Pollution caused by paper industry accounts for 30% of the water pollution over. In particular, many years ago there was a period of "little paper" blossom everywhere, straw pulp papermaking raw materials dominate the market, sewage discharge everywhere, causing damage to the ecological environment. Paper-making enterprises in China had reached up to more than 20,000, mostly small factory town, with an average annual production is only 02,500 tons. This scale with the world average of 64,200 tons, the gap considerably.

China Paper by "small", by "grass" development over 40 years. "Said the objective reality of this development process has its own rationality." In this year 91-year-old engineering experts Yi-Ji paper appears low per capita forest resources, the state paper industry with less investment, make full use of straw, rice straw, wheat paper-making raw materials such as straw stalk is also the choice of conditions at that time.

Although the presence of small paper mills to reduce the number of imported paper and pulp, but the scale and obsolete equipment, high energy consumption, about 75% of the base and containing organic waste recovery and treatment are not effective, heavily polluted environment. But also for paper single product structure, low quality. August 1998, including the Yi-Ji forest and paper, including 15 experts jointly by the "speed up the plantation building, revitalization of the Chinese paper" proposal. Since then, the state authorities were seriously discussed and reached consensus, proposed the "speed up the integration of forest and paper, the revitalization of China's paper industry," the views of the development of our country FPI opened a new chapter.

From the late 90 century begins, keep paper industry pollution remediation and closure of a large number of tons of these small factories. To 2009, annual sales income of 500 paper-making business enterprises yuan more than the number dropped to 3,500.

To change the paper industry technology and equipment behind the situation, the relevant state ministries and also the outstanding issues under the paper industry and domestic market demand, the paper industry as bonds to support the technological transformation of key industries. Some had not installed wastewater treatment equipment company started the construction of sewage treatment plants, some had insufficient processing capacity and processing enterprises are not fully started to improve sewage treatment facilities.

Paper industry clean production technology has made unprecedented progress. The development of papermaking chemicals, large-scale introduction and development of high-speed paper machine, pulp and waste paper utilization rate of the upgrade, have greatly reduced water consumption and pollutant emissions of paper. Meanwhile, with the scientific progress and technological innovation, papermaking wastewater treatment technology is relatively mature, water pollution levels have been greatly enhanced.

According to statistics, China's paper production from 32 million tons in 2001 to 93.89 million tons in 2009, production increased nearly 2-fold, while the COD emissions dropped from 2.03 million tons to 150 tons, down 26.1%, 10 000 COD emissions per production value also decreased from 0.168 tons to 0.04 tons, down 76%. Wu Kong from the Department of Environmental Protection Division's data, the current top 100 Chinese enterprises large paper production accounts for 55.74% of total production paper, while the total COD emissions account for only 10%.

(C) With China's rapid economic development, China's paper industry has undergone enormous changes. China's paper industry relies on technological advances and information transformation, to achieve the transition to advanced manufacturing, production ranks second in the world, product grades improved.

Paper and paperboard production increased from 14.43 million tons in 1990 to nearly 93.89 million tons in 2009, an increase of 5.5 times the average annual growth rate of about 18%. National production of paper has gone from the last century 70's 430 to today's 700 or so, basically meet the needs of the community.

In recent years, China's paper industry, including the potential to attract international capital markets, including a lot of money, the paper industry there is a unprecedented technological transformation and progress to a climax. Guangdong, Fujian, Zhejiang, Jiangsu, Shandong and other coastal provinces in the paper industry by leaps and bounds, some of the major industrialized region of the transition. Paper-making industry into the international advanced technology and equipment, the production capacity of advanced production technology accounts for 20% of the industry, is still in the process of modernization.

China in 1995 introduced the first paper of dry glue equipment soon after production started to melt and success of dry paper. This heat combined with the loose thickness of paper is good, bulky good, high elongation, wet strength, high flexibility and other advantages, better than the glue on paper, has been commercialized, used in hygiene products, medical supplies and industrial products, etc. fields.

(D) the traditional publishing model, a large number of printed materials consumed considerable resources, but also had a serious industrial pollution. With the development of the Internet, no paper to read, paperless office will definitely become a trend.

In the 2008 Frankfurt Book Fair, one for more than 30 countries, 1,000 professionals in the publishing industry survey showed that 40% of people believe that by 2018, sales of digital books will overtake traditional books.

Electronic paper display technology not only has the visual effect of the printing paper, and processing of information in low power consumption, these advantages make electronic paper will be widely used. Industry studies suggest that e-paper market is expected to reach 2.1 billion by 2015, 2020, 70 billion dollars. E-book reader that uses the best characteristics of electronic paper. And compared with traditional LCD screens, electronic paper, low power consumption and closer to the traditional paper's visibility, making it a dedicated e-book readers are an important component.

E-paper's development will the traditional paper, printing, publishing industry have a certain impact, particularly in relation to books and paper companies also should take preventive measures to actively respond to read the paperless era.

I am an expert from China Hardware Suppliers, usually analyzes all kind of industries situation, such as pen laser pointers , high power laser pointers

Video- Upscaling Performance at Abitii Bowater

Last Updated: Tuesday, August 24, 2010

4:34 PM ET Comments21Recommend8; The Canadian Press

AbitibiBowater has permanently closed two idled Quebec paper mills that once employed 570 people.

The newsprint giant, which has been operating under bankruptcy-court protection from creditors for more than a year, said Tuesday the facilities in Dolbeau and Gatineau won't be part of its operations when it restructures this fall.

"It's part of our restructuring efforts and the idea is to give our creditors and the court the most precise portrait of what the company will look like after it emerges [from court protection]," spokesman Pierre Choquette said in an interview.

Production had ceased in Dolbeau in June 2009, affecting 240 workers, while 330 jobs were affected when the Gatineau mill was silenced in April.

Choquette said the Montreal-based company won't make any decision about selling or dismantling the sites until local studies about potential alternative uses are completed.

AbitibiBowater has provided some financial support to assist with the study in Gatineau.

"What we told the people in Gatineau is that we were willing to wait for the conclusions of that study before taking other decisions," Choquette said.

Used for scrap

Some other closed mills have been sold to a metal scrapper for dismantling after Abitibi said it could no longer use them for paper production.

AbitibiBowater filed for court protection from creditors in Canada and the United States since April 2009. It hopes to exit as a lower-cost producer in mid-October after reducing production capacity to match lower newsprint demand.

The union representing workers said it was "disappointed and distressed" by the company's decision to close the two Quebec sites.

Renaud Gagné, vice-president of the Communications, Energy and Paperworkers Union in Quebec, said the union understands that Abitibi has a financial incentive to make this move under the Companies' Creditors Arrangement Act because of how severance will be treated differently.

"But it's quite shocking for workers. They always pay the ultimate price because they won't receive some of the money they are owed," Gagné said in a release.

Earlier this week, AbitibiBowater CEO David Patterson urged employees who are owed money to approve the company's reorganization plans.

"This is a significant step forward in our restructuring process, and we remain on track to emerge in the fall a stronger, more sustainable company," he said in a letter.

Several groups, including the court-appointed monitor, have estimated that unsecured creditors, such as employees, would recover more of their claims than if it proceeds to liquidation.

"We have our sights set on building an organization with a leaner financial model, a low-cost and flexible operating platform and a diverse and innovative mix of products, capable of nimbly reacting to industry dynamics," Patterson said.

Read more: http://www.cbc.ca/canada/montreal/story/2010/08/24/que-abitibibowater-plants.html#ixzz0yNKe5oAt

Video - JK Paper Stock

JK DOES A FIRST IN BRANDED PAPER MARKET

In a first-of-its-kind move in the branded paper segment, J K Paper has tied up with Hewlett Packard (HP) to avail of its ColorLok technology in producing copier paper.

In a first-of-its-kind move in the branded paper segment, J K Paper has tied up with Hewlett Packard (HP) to avail of its ColorLok technology in producing copier paper.

ColorLok papers lock ink at the surface of the paper for improved print quality and are suitable for use in both laser and ink jet printers, photocopiers and all DTP applications.

"ColorLok paper provides better quality printing. It also reduces printing costs significantly. By providing good quality duplex printing and cutting down on paper jamming, the technology provides for reduced paper usage", says Kimberly H Eliott, strategic alliance manager, HP.

On an average, 30,000-35,000 sheets of regular paper are printed depending on the configuration of the printer.

Assuming maintenance cycles are kept the same, executives from HP claim, 50,000-70,000 sheets can be printed using paper produced with ColorLok technology.

Eliott explains, "The cost of printing a paper is largely dependent on the life of a printer. ColorLok technology reduces abrasion in papers enabling printers to run smoothly, which increases the life of printers.

For instance, a component in laser printers - fuser - that costs over Rs 10,000 in India lasts 40 per cent longer if ColorLok paper is used."

J K Paper is the eleventh company worldwide to be awarded certification by HP to produce ColorLok paper.

J K Paper has five brands in the copier segment namely J K Copier, J K Easy Copier, J K Copier Plus, Sparkle and Cedar.

Harsh Pati Singhania, chairman and managing director, J K Paper, says the cost of production of ColorLok paper is slightly higher than that of regular copier.

However, prices would remain unchanged for the time being to promote awareness about the new technology.

ColorLok paper would be distributed across J K Paper's network of 3,000 dealers in the country.

J K Paper currently has 28 per cent market share in the branded paper segment and is expecting to corner 40 per cent share in the copier segment. BILT, West Coast, Century are the other leading papers in the branded paper market.

J K Paper produces 0.24 million tonnes of paper per annum. This is projected to go up to 0.40 million tonnes on completion of the expansion project.

The branded or copier paper segment in India, at present, is estimated at 0.40 million tonnes per annum. In terms of volumes, it constitutes roughly four per cent of the overall paper industry of 10 million tonnes.

The segment, the fastest growing in the industry, is growing at a compounded annual growth rate (CAGR) of 15 per cent.